Environmental benefits of CNG, LNG and RNG-fuelled truck fleets

FortisBC is working to reduce emissions by helping customers transition from heavier carbon fuels like diesel to lower-carbon fuels like compressed natural gas (CNG), liquefied natural gas (LNG) and Renewable Natural Gas1 (RNG).

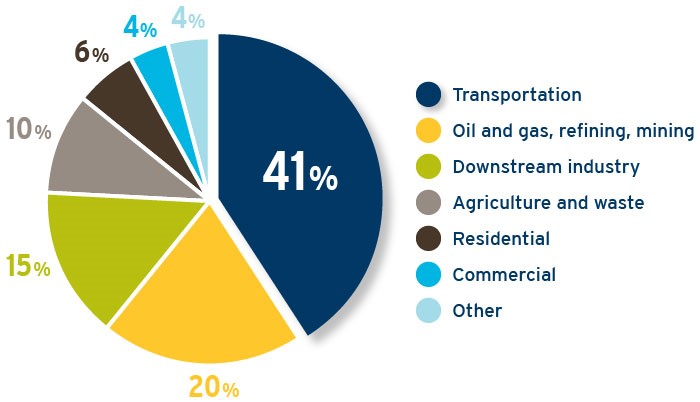

BC’s GHG emissions by sector

At 41 per cent of provincial GHG emissions, transportation accounts for the largest emissions footprint in BC.1 With so much room for improvement, we’re excited to be offering cost-effective solutions to help lower emissions. Learn all the ways we’re working towards a low emission transportation sector.

Emission reductions: fuelling with LNG or CNG compared with diesel or gasoline2

- GHG emissions: Natural gas vehicles emit up to 30 per cent less GHG emissions.

- Nitrogen oxides (NOx): Natural gas vehicles emit up to 95 per cent less NOx. These gases can be harmful to human health and the environment, and are one of the primary contributors to the formation of ground-level ozone.3

- Particulate matter: natural gas vehicles emit virtually no particulate matter, the harmful microscopic component of air pollution that penetrates deeply into the lungs.

Emission reductions: fuelling with RNG compared with diesel or gasoline

- Greenhouse gas (GHG) emissions: Renewable Natural Gas can be used seamlessly with natural gas engines, reducing GHG emissions by upwards of 85 per cent when replacing the combustion of conventional diesel fuel.

- Nitrogen oxides (NOx): Natural gas vehicles emit up to 95 per cent less NOx. These gases can be harmful to human health and the environment and are one of the primary contributors to the formation of ground-level ozone. 3

- Particulate matter: natural gas vehicles emit virtually no particulate matter, a harmful microscopic component of air pollution that penetrates deeply into the lungs.

Looking forward: fuelling with hydrogen

We’re investing in future solutions for our customers, for even greater emission reductions:

Hydrogen blending - We’re investing $500,000 to study how we can further reduce GHG emissions from our natural gas supply by delivering hydrogen, a carbon free energy, through our extensive distribution network. The School of Engineering at the University of British Columbia’s Okanagan campus will use these funds to study how to blend hydrogen, safely and reliably, with natural gas. The study began in 2020 and is ongoing.

1Renewable Natural Gas (also called RNG or biomethane) is produced in a different manner than conventional natural gas. It is derived from biogas, which is produced from decomposing organic waste from landfills, agricultural waste and wastewater

from treatment facilities. The biogas is captured and cleaned to create Renewable Natural Gas.

2Pathways for British Columbia to achieve its GHG reduction goals;

Guidehouse, 2020, p11.

3Northwest Gas Association, Natural gas facts, page 15

4Common air pollutants: nitrogen oxides; Environment and natural resources, Government of Canada

BC carbon credits and carbon tax

Carbon credits

Because natural gas is a lower carbon fuel than gasoline or diesel, making the switch from those fuels to natural gas means you could be eligible for carbon credits, which you can sell. How does this process work?

- We send you an annual report of your natural gas fuel usage for the year. You submit this information to the BC Ministry of Energy, Mines and Low Carbon Innovation.

- The Ministry determines whether or not to validate your credits.

- If validated, you can sell those credits via the credit market, or via a broker.

Learn more about the BC government’s Renewable & Low Carbon Fuel Requirements Regulation.

Carbon tax

Like gasoline or diesel, natural gas for transportation is subject to the BC carbon tax. But since natural gas is a lower carbon fuel, it’s taxed at a lower rate than gasoline or diesel.

The current carbon tax rate is $40/tonne, which must be translated based on the type of fuel used.3

Learn more about the BC Motor fuel tax and carbon tax.